WHY MOBILE HOME PARKS ARE BETTER THAN GOLD By Frank Rolfe

Article Featured

Robert Kiyosaki – the author of “Rich Dad Poor Dad” from 1997 – has recently turned to pitching investing in gold as the best hedge to the end of America. We disagree with that. Mobile home parks are definitely a better investment option than gold if the topic is best defense against the collapse of the U.S. economy. But let’s break that down into actual statistics to prove that argument.

First, are we really going to have a depression?

Warren Buffett let his opinion be known when he recently declared that the “glorious period” of the American economy was over. But he’s not alone. If you simply google up “recession predictions” you’ll see that virtually every decent economist in the U.S. agrees that there will be a major correction within the next 18 months – they just can’t predict the precise date of the decline. Past experience has shown that the combination of high interest rates, high inflation and $33 trillion in U.S. debt is a recipe for Armageddon. Just ask Jimmy Carter. And Carter experienced the worst type of decline, which is called “stagflation”. Under “stagflation” you have an economic collapse coupled with high inflation. And the setting is similar as oil prices were the trigger and they are again at $100 per barrel. The only way to cure stagflation is to deregulate the energy industry and lower oil prices, and Biden’s failing “green” focus is unlikely to change even in the face of the worst inflation in nearly half a century.

How has gold performed historically?

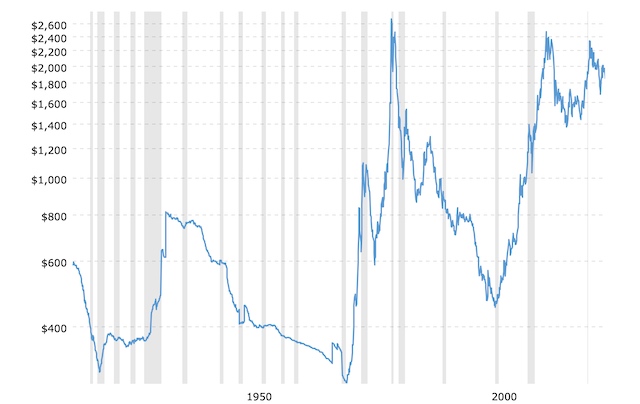

So let’s turn to the reality of gold investing – not just the hype. When you pull the chart of gold prices per ounce off the internet you note some very troubling news:

|

You’ll note that the three all-time lows for gold over the past 100 years were in 1920 and 1970 and 2000. The problem is all three of those years were during recessions, the most recent being the “DotCom” bust. If history is any indication, that would suggest that gold does not fare well in times of recession. But what about the boom in gold pricing. Well, you can clearly see from the chart that if you bought an ounce of gold in 1980 you paid $2,675. 40 years later it has still never hit that price again, with the highest peak occurring in 2001 at $2,192. Today’s price of $1,940 per ounce was the same as it was in 1981. In other words, if you bought an ounce of gold in 1981 as an investment and held it for 42 years it … would only be worth what you paid for it. Nobody could look at this chart of gold pricing and even remotely consider it a winning investment strategy. If you compare the chart to what happened in each year you quickly realize that gold is actually just a way to hold a base value against the dollar. The only time it ever performed well was during the window of the run-up to the recession, such as 1970 to 1980 and 2000 to 2010. In other words, it only actually goes up when the economy is doing well, not the other way around. It’s definitely not a contrarian play and it definitely is not what you invest in when the economy is going south.

What limitations does gold have as an investment tool?

As an investment tool, gold has some serious limitations:

- It pays no dividends.

- It is hard to sell, unless you have access to a willing buyer who deals in gold.

- It has never been able to break its price ceiling set in 1980. If you look at the chart it always trades in a range of around $400 per ounce to around $2,000 per ounce.

- Your timing for gold right now is terrible, as with the price already at near all time highs it has no room for increase and you – based on the entire chart of historical gold performance – are literally buying it an it’s peak and are looking at nothing but downside.

It would be great if we had a chart of mobile home park values for the past 100 years – just like gold has – but sadly our national associations have tracked virtually no data other than mobile home manufacturing shipments. But we can tell you from experience how the last two major recessions: the “Dot Com” bust and the “Great Recession”.

- The “Dot Com” bust happened in 2000 and the net effect was extremely beneficial to mobile home park owners. Interest rates dropped and the demand for affordable housing spiked, resulting in strong gains in lot rents.

- The “Great Recession” in 2008 was even better, with interest rates being reduced to all-time lows of 0.25% and the housing disruption resulting in the highest demand for mobile homes and mobile home parks in U.S. history. This was the same period in which apartments had the largest increase in rents in recorded times, and mobile home park lot rents mirrored those gains.

What limitation do mobile home parks have as an investment tool?

As an investment tool, mobile home parks have some unique strengths:

- By being the lowest cost form of housing in the U.S., demand goes up every time the economy declines – while staying constantly high even during boom times.

- Since cities have not allowed new parks to be built in nearly 50 years there is absolutely no new construction to contend with (unlike apartments which always have new units going up).

- Mobile home park lot rents are incredibly low (an average of $280 per month in the U.S.) and those could double or triple and still be insanely cheap compared to all other housing options.

- Mobile home parks pay monthly dividends in the form of revenue less expenses.

But they also have some weaknesses:

- The business model is much more difficult than gold, as with gold you simply call and buy some but mobile home parks require thought and strategy.

- The average American knows nothing about mobile home parks and are therefore prone to screw it up, as most everyone knows what gold is and all you do is buy it and put it in your safe.

Putting it all together

The bottom line is that mobile home parks and gold have two different niches in the investment world. Gold is, in fact, not contrarian as the price rises in tandem with good economic times, and then goes down during recessions. Mobile home parks, on the other hand, actually perform better as the economy declines. Additionally, gold pays no dividends and has periods of decades in which prices have not risen at all. On the other hand, mobile home parks pay out monthly dividends and have never had a “flat” period in terms of appreciation of rents and values.

Conclusion

In the contest of gold vs. mobile home parks, mobile home parks will always win. Gold is terribly misconstrued based on the efforts of those trying to promote it – and a simple look at the historical chart of gold prices proves out the mislabeling of gold as a contrarian hedge.

If you want more information on the correct way to identify, evaluate, negotiate, perform due diligence on, renegotiate, finance, turn-around and operate mobile home parks then consider attending our next Mobile Home Park Investor’s Boot Camp. It’s a live three-day immersion weekend in which you will learn the industry from A to Z – and your instructor is not only part of the 5th largest ownership group of parks in the U.S. but also the guy the New York Times calls “the human encyclopedia of all things mobile home park”. The event is virtual so there is no travel cost or time and is Q&A throughout. You also receive evaluation software, the list of all the mobile home parks in the U.S., and a reference library of every form and contract you should ever need.

By Frank Rolfe

Frank Rolfe has been an investor in mobile home parks for almost 30 years, and has owned and operated hundreds of mobile home parks during that time. He is currently ranked, with his partner Dave Reynolds, as the 5th largest mobile home park owner in the U.S., with around 20,000 lots spread out over 25 states. Along the way, Frank began writing about the industry, and his books, coupled with those of his partner Dave Reynolds, evolved into a course and boot camp on mobile home park investing that has become the leader in this niche of commercial real estate.